4 Key Trends in Financial Software Development

There is a massive transformation happening in the financial services industry due to technological advancements and evolving consumer expectations. Key to this transformation has been advances in financial software development as companies innovate, improve operational efficiencies and create better customer experiences. In response to these trends, an article has been developed to take a deep dive into the major breakthroughs defining financial software development and unearthing more upon highlights on how developments in this niche affects global industries.

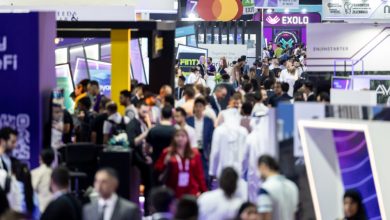

The Rise of Fintech Solutions

With a machine-like version of human oversight, the financial services industry has been transformed by disruptive fintech (financial technology). Fintech companies are using very advanced tech-enabled tools to change the way banking and financial services work, with innovative products that meet consumer needs today.

Mobile Banking and Payments

Consumers and businesses of all sizes can benefit, as mobile banking & payment solutions have changed the way people interact with financial services. Users can manage and control their finances, make payments & transfers if they need be and access traditional banking services on their cellphones via these applications.

Lately we’re seeing all our favorite payment apps such as Venmo, PayPal and Cash App explode in popularity. Similarly, traditional banks have also gone mobile with apps like Chase Mobile or Bank of America Mobile Banking.

Digital Wallets

Digital wallets are one more sort of fintech that has in a lot of ways changed the economic landscape. They are secure wallets that store payment details and allow you to pay for stuff without cash or using your pocket card with a simple tap.

Other than the fact they work, Apple Pay and Google Wallet are pretty pedestrian – just another digital wallet to use side-by-side with traditional payment methods.

1) AI and ML

In financial app development, Artificial Intelligence (AI) and Machine Learning (ML) are acting as a spine. Initiatives are using these technologies to improve everything from customer service in financial services and insurtech, through to risk management.

- Customer-Centric Engagement. Financial institutions can now capitalize on AI and ML to provide customers with bespoke experiences, by utilizing an abundance of data reservoirs that the solution solutions analyze, in order to understand individual liking or dislike patterns. This customization makes for happier and returning customers.

Artificial Intelligence-Powered Chatbots for Instant Customer Support and Product Recommendations Credit unions, along with traditional banks and fintech companies deploy chatbots powered by AI to provide instant customer support and query responses; leverage data analytics capabilities using the user’s financial history or behavioral analysis laying down personalized product recommendations.

- Fraud Detection and Risk Management. Vendors are employing AI and ML for better fraud prevention and risk management as well. Real-time transaction pattern analysis- These technologies monitor transactions as they occur and detect any anomalies indicative of fraudulent activities.

By using machine learning algorithms, credit card companies better recognize unusual purchasing behavior and high probability fraud which could help to prevent unwanted transactions protecting the general public.

2) Blockchain and Cryptocurrency

In financial software development, both blockchain technology and cryptocurrencies have paved the way for new trends. This will bring novel options in transaction execution, value storage and financial operation security/ transparency.

Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is a blockchain-based form of finance that does not rely on central financial intermediaries such as brokerages, exchanges or banks. DeFi platforms allow for users to lend, borrow, trade and invest in a decentralized fashion.

As a result, platforms like Uniswap, Compound and Aave have gained popularity allowing users to perform financial activities without need for traditional middlemen. Using smart contracts for securing and executing transactions across various platforms.

Cryptocurrencies and Digital Assets

Cryptocurrencies and digital assets are going more mainstream every year as they get increasingly adopted by financial institutions (now including PayPal), consumers, and even institutional investors. More recently, fintech development concentrates on building products with cryptocurrency support and secure storage to help things like crypto transactions.

There are many excellent places where you can buy and sell bitcoin, but Coinbase or Binance offer a fast way to get started compared to other options. Families of traditional financial institutions are also checking out the water in a splash, matured enough over blockchain technology space to innovate their workflow and onboard new products.

3) Cloud computing

Cloud computing and API integration are the key trends driving modern software for financial services. They help financial institutions to streamline their operations, as well as secure and provide services with the latest technologies.

Financial companies can greatly benefit from cloud computing, since with the help of easily deployable and scalable hybrid, public or private cloud applications their business will be more competitive. Cloud-based solutions also mean easy to update and maintain, so that financial software solutions always remain secure and current.

One trend that we are witnessing is banks & financial institutions moving their core banking systems to the cloud and accessing services such as AWS, Google Cloud or Microsoft Azure for bolstering IT infrastructure of these enterprises.

4) API Integration

An API (Application Programming Interface) is a set of accessible requests that all software systems can use to communicate and work together. Among other use cases in financial services, APIs facilitate the integration of different applications and enable access to external third-party solutions or features.

The API for open banking allows third party developers to create applications and services around the financial institution. This enables innovation and greater consumer choice, leading to more competition in financial products.

Conclusion

Financial software development landscape emerging rapidly, the financial development environment is being elastically conformed over several innovations in fintech, advancements of AI and ML technology blocks like blockchain tech notably also driving adoption side-by-side with cloud technologies empowering these API-first approaches. Technologies needed to realize these trends are changing the dynamics of financial services making room for new businesses and experiences. After all, financial institutions that side with these trends will be able to compete effectively and keep pace with evolving consumer expectations in the new digital era. With the industry continuously changing, businesses that stay agile with these trends will perform better on this fast-paced financial landscape.