Monarch Money Review: Create a Plan for Your Money

Monarch Money

Product Name: Monarch Money

Product Description: Monarch Money is a budgeting app that can monitor your financial progress and make it easier to plan for the future.

Summary

Monarch Money is a budgeting app that tracks your spending against your budget and automatically pulls your recurring expenses into a calendar format. You can also track your net worth and investments. It also allows for unlimited contributors.

Pros

- Automatically downloads and categorizes transactions

- Calendar view of recurring charges

- Free to add other users

- View brokerage account positions alongside banking balances

Cons

- No free plan

- No credit score monitoring

- Doesn’t sync with non-traditional financial accounts

Are you looking for a financial app that can track your banking accounts, help you budget, and suggest ways to improve your finances?

Monarch Money is a popular budgeting app that allows you to see all your financial accounts in one place. For example, the app syncs to most bank accounts, lets you create unlimited budgets, and tracks your investments and net worth.

This Monarch Money review covers the various financial tools available to you.

For a limited time, Monarch is offering 30% off your first year with the coupon code WELCOME. This code is valid starting September 21st, 2024.

At a Glance

- Set up a customized budget

- Automatically identifies recurring expenses

- Add unlimited contributors to the budget

- Track your net worth and investments

Who Should Use Monarch Money?

Monarch is great for tracking all of one’s financial accounts in one place. You can see your budget and everyday spending alongside your net worth. You can create customized reports and try out different scenarios to see how they play out long term.

You can also add unlimited contributors to your budget, which is perfect for couples or those working with a financial coach or advisor.

Alternatives to Monarch Money

| Pricing | $9.08 per month or $109 per year | Free | $10 per month or $100 per year |

| Best feature | Budgeting | Net worth tracking | Budgeting |

| Investment tracking | No | Yes | No |

| Learn more | Learn more | Learn more |

Table of Contents

- At a Glance

- Who Should Use Monarch Money?

- Alternatives to Monarch Money

- What Is Monarch Money?

- How Monarch Money Works

- Monarch Money Features

- Budget

- Financial Goals

- Investment Tracking

- Recurring Expense Tracker

- Net Worth Tracker

- Joint Finances

- Customized Charts

- Alternatives to Monarch Money

- Money Monarch FAQs

- Monarch Money Review: Final Thoughts

What Is Monarch Money?

Monarch Money is a budgeting app and net worth tracker. It is free for seven days, and then it is $99 per year.

Some of the intriguing features include:

- A monthly budget

- Savings goals

- Net worth tracking

- Subscription management

- Calendar view of upcoming bills

Individuals and couples can budget together. You can also add a financial advisor as a collaborator to provide additional insights.

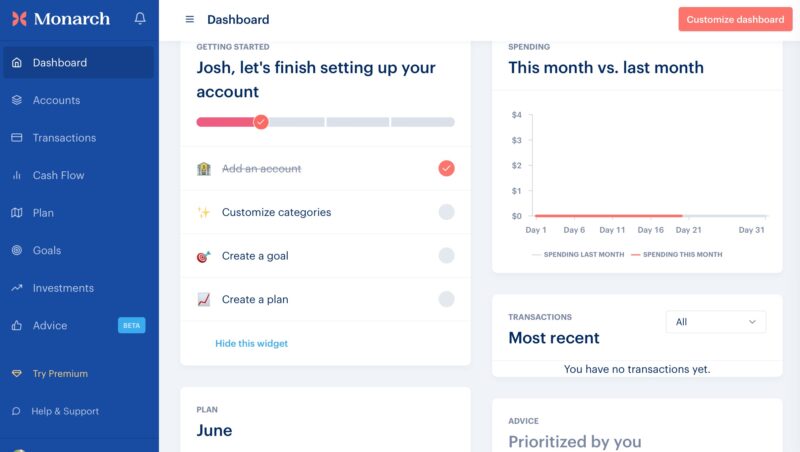

How Monarch Money Works

You can access Monarch Money by a mobile app (Android or iOS) and the online website.

Upon joining, the service will sync with your bank and investment accounts (over 11,200 available institutions). The free version allows you to connect up to two bank accounts, and investment tracking is only for paid subscribers.

Once your accounts are connected, the app walks you through its various functions, like budgeting and goal setting. Monarch will pull transactions from your linked accounts, and you can assign a specific income or expense category to make an accurate budget.

As the months roll on, you can log contributions for savings goals and act on the advice for other financial topics like retirement planning and getting necessary insurance.

Monarch Money Features

Monarch Money is packed with tools to help you track your spending and plan for future goals. Let’s take a closer look at some of its best features:

Budget

Of course, a budgeting tool will have a budget, but it’s a good place to start, nonetheless. The monthly spending plan lets you forecast upcoming monthly expenses by category. Taking it further, you can quickly compare your actual budget figures to your planned expenses. You can adjust your planned category spending for each month to account for one-off events like a vacation or an expensive car repair.

The various budget categories are expansive and cover the most common household expenses, business income, taxes, health and wellness, and more. You can also customize the categories for income and expenses to get a more realistic household budget.

Monarch Money automatically categorizes your transactions, but you must adjust several category assignments. You will probably need to modify the monthly budget’s planned and actual spending amounts – the same goes for most budget software.

Customizable budget categories are just a start. Some of the other nifty features include:

- Rollover budgets: Roll your monthly savings into next month’s budget. This capability makes tracking your disposable income for life’s variable expenses easier.

- Track your progress: You can always see exactly how you are doing throughout the month. This helps you stay on budget and makes it easier to meet your goals. You can also pull a monthly progress report.

- Test scenarios: You can plug in different scenarios and see how they impact your long-term finances.

- Retirement planning: You can see how your spending impacts your retirement plans.

Financial Goals

Instead of creating savings goals in your savings account, you can build them within this platform to see your entire financial picture in one place.

This feature is similar to other financial platforms. You assign a savings goal and deadline. Then, as you set aside new funds for the purpose, you can update your progress, which is displayed with an interactive graph.

Investment Tracking

You can sync unlimited investment accounts to track the performance of individual stocks and funds and even crypto. You can view your allocations and see the historical performance of your investments.

You can also see how your performance stacks up against benchmarks, such as the S&P 500 and VTI.

Recurring Expense Tracker

We all have recurring expenses, and Monarch will automatically detect them and put them into a calendar view. You can also manually add recurring expenses if needed. This can be so helpful if you plan your budget based on when you get paid. You’ll also get a reminder notification three days before the bill is due.

Net Worth Tracker

The platform can track your cash and investment balances to calculate your liquid net worth. You can also estimate your home value through Zillow. If you have accounts that won’t sync, you can add them manually.

While this tool is helpful, it doesn’t track every net worth metric. Other services specializing in tracking net worth can be better if this task is more important than budgeting.

Joint Finances

You can add unlimited collaborators, including your spouse, financial advisor, adult children, etc. This hands-on access is available to free and paid members.

Being able to have multiple collaborators can make it easier to build a household budget. If you’re seeking professional financial advice, your advisor can get their own Monarch login, and Multi-factor Authentication (MFA), to (securely) help you make a long-term plan. Other budgeting apps may charge extra for multiple users, but that’s not the case with Monarch Money.

Customized Charts

You can create custom reports to see your spending patterns in the way that works best for you. You can see things like top merchants, your savings rate, spending over a set date, spending by tags, and more.

You can export the images or download the data into a spreadsheet.

Alternatives to Monarch Money

There’s a lot of competition in the budgeting app space, and Monarch Money has several competitors – names like Mint and YNAB. Here are some free and paid Monarch Money alternatives for you to consider, if none of these are good fit check out list of the best budgeting apps for couples.

YNAB

Consider YNAB (You Need a Budget) if you’re serious about budgeting. This app syncs with multiple devices, including computers, phones, and wearables.

This program practices zero-based budgeting to assign a purpose to every dollar you earn. The ultimate goal is to pay this month’s bills with last month’s income instead of living paycheck to paycheck.

After a 34-day free trial, you pay $14.99 per month or $109 annually with a one-time payment.

While YNAB costs more than Monarch Money, it has more in-depth budgeting features. In addition, it can be compatible with more devices, making budgeting easier. Learn more in our full YNAB review.

Empower (formerly Personal Capital)

Empower is better if you mostly want to track your net worth and investment performance. It’s also free to use. The service also has a basic budgeting tool which can be helpful if you have a firm grasp on living within your means and are ready to increase your disposable income to save for long-term goals.

Read our full Empower review to discover all of the financial tools.

Lunch Money

Lunch Money is a budgeting app that, as expected, allows you to set spending categories. It then imports your transactions and categorizes them into your spending categories. It also automatically identifies your recurring expenses and allows for unlimited collaborators. It will track your net worth, but you can’t track your investments.

It costs $10 per month or $100 annually.

Learn more at our full Lunch Money Review.

Is there a Monarch Money app?

Yes, an iOS and Android app are available. The app may display exclusive reports that web browser users cannot access. Additionally, the iOS app can track Apple Card purchases.

Is Monarch Money safe?

Yes. Monarch Money uses bank-level security to protect your financial data. The service won’t collect sensitive information such as your Social Security number. Additionally, the app uses Finicity, a third-party service, to connect to your financial accounts to avoid storing your banking credentials on the Monarch server.

What are the Monarch Money customer service options?

Email support is the only way to receive hands-on help. Paid subscribers receive priority support. An online FAQ library or interactive feature walkthroughs can help you navigate the easy-to-use platform.

Monarch Money Review: Final Thoughts

In the world of budgeting apps, Monarch Money is a solid choice. In my opinion, the cost is worth it since it gives you a lot of control over your finances and will likely be a net positive your financial situation.

It also allows you to track your investments and sync unlimited accounts. However, Personal Capital is an excellent alternative for this if you don’t need in-depth budgeting tools.

For a limited time, Monarch is offering 30% off your first year with the coupon code WELCOME. This code is valid starting September 21st, 2024.

Other Posts You May Enjoy:

StellarFi Review 2024: Is it Worth It?

StellarFi is a credit building tool that works by reporting your regular monthly bills to two major credit bureaus. This saves you from having to borrow money or pay a security deposit to build credit. Is it worth it? Find out in this StellarFi review.

SoFi® Checking & Savings Review: A Bank Account with a Cash Bonus

SoFi Money Product Name: SoFi Money Product Description: SoFi’s bank account is a checking and savings combination that earns a…

5 Best Banks That Don’t Use ChexSystems

Chexsystems is like a credit-reporting agency for bank accounts. Unfortunately, a low Chexsystems score can make it difficult to open a checking account. If you’re struggling with a low Chexsystems score, here’s a list of fifteen banks that don’t use Chexsystems, where you can open an account.

How to Convert Visa Gift Cards to Cash

Gift cards are great, especially when you get them for free. But sometimes, you just need cold, hard cash to pay the rent, send a friend some money, or catch up on some bills. In this article, I’ll show you how to convert your Visa gift card to cash.

About Josh Patoka

After graduating in $50k with student loans in May 2008 from Virginia Military Institute with a B.A. International Studies and Political Science with a minor in Spanish (he studied abroad in Sevilla, Spain for 3 months), Josh decided to sell his soul for seven years by working in the transportation industry to get out of debt ASAP and focus on doing something else with a better work-life balance.

He is a father of three and has been writing about (almost) everything personal finance since 2015. You can also find him at his own blog Money Buffalo where he shares his personal experience of becoming debt-free (twice) and taking a 50%+ pay cut when he changed careers.

Today, Josh relishes the flexibility of being self-employed and debt-free and encourages others to pursue their dreams. Josh enjoys spending his free time reading books and spending time with his wife and three children.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.